I’m rich!

… Well, I’m richer than I used to be.

Back in 1995, when I started working at Hughes, I needed to buy a new car. As part of the GM family, Hughes employees received a discount on the purchase of GM vehicles… which was great, except the only way to receive the discount was to also be a part of the Hughes Federal Employees Credit Union.

The minimum balance to open an account was five bucks, so I dropped a check in the mail and became a proud member of a credit union. I bought the car, got my discount, and drove home happy.

Over the years, I’ve never really done anything with that account. There didn’t seem to be any reason to close it, because sometime I might want to add some money to it (I think it earns more interest than a standard bank checking account) and because there are no maintenance fees. So every quarter I get a statement from them– they’re now called Kinecta for reasons only marketing people would understand– and dutifully file it in a folder somewhere.

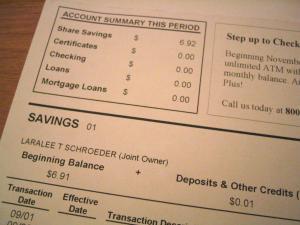

The funny thing is that over the years, I’ve accrued interest on that account. Never adding or removing anything, I’ve managed to collect almost two dollars in interest. A typical quarter will bring me a few additional cents, and now my balance stands at $6.92. Wow, the power of compound interest!

Of course, out of a sense of duty I’ve included this account information on every loan application I’ve made for the four houses we’ve purchased. They ask you to bare your financial soul, so I give them my bank account balance, my savings account balance, the estimated value of my cars, and– lest we forget– the seven bucks sitting in my credit union account. I hope those mortgage people look it up, just to make sure I’m giving factual data.

Maybe by the time I retire, I’ll have enough money to go out and buy some ice cream or something. Thank goodness for credit unions!