Every two weeks, on payday, I use my online Chase account to send money to several employees. I use their free “QuickPay” service to transfer expense reimbursements to them, and they connect their QuickPay account to their bank so the money gets transferred electronically. Each time, I also send a couple of employees a full paycheck. However, QuickPay has a $5,000 limit so I can’t do it for everyone. It’s annoying, but okay, I understand.

Lately, every time I do this, I get an automated phone call from Chase asking me to verify that the transaction is valid. In some cases we’re talking about $50 or $100 for expenses. So I have to answer a bunch of questions about the car I own, the street address of my house, yada yada. I understand that if I add a new employee and pay them, it makes sense for Chase to verify that it was intentional to prevent fraud. Once. But every time? It’s the same people every two weeks, and often the same amounts (since their paychecks don’t change).

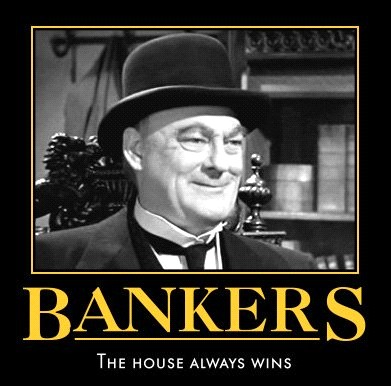

I finally got fed up with it this morning and called the Chase web team to see if that verification could be disabled. After literally ten minutes of the guy talking to someone else about it, he told me it couldn’t be done. But hey, I could sign up for Chase’s payroll service! For $10 a month I can do exactly what I’m doing now but it wouldn’t ask me to verify the payments.

Me: “So it sounds like your system is just annoying me, and you’re saying I can pay $10 a month to stop being annoyed.”

Chase rep: “Yes sir, that’s how it works.”

Nice.