Today I’m cleaning out the crawlspace, and I found a box full of my pay stubs from the distant past. I have no idea why I even kept all of that stuff, but it was interesting to look through the stacks and think about those golden days.

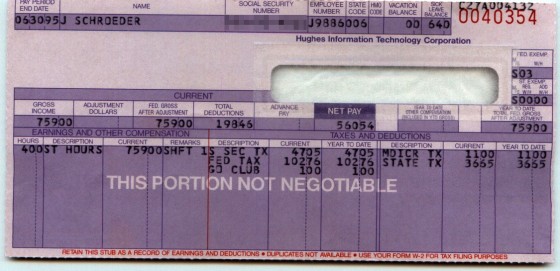

After graduating from UMR in the spring of 1995, I started my first “real” job at Hughes Information Technology Corporation. At the time, my salary was $759/week– almost $40k/year. Wow. It was more money than I knew what to do with. I still remember opening the offer letter in college and being floored by the prospect of that kind of money. When you’re used to a weekly budget of $20 to buy pizza, it’s a big change.

Giddy with the prospect of being a bachelor with so much money, I immediately bought a new bigscreen TV. Well, it was 32″ but back in 1995 that was huge. Of course with a new TV I needed a new VCR. That led to a new entertainment center. Oh, and since my trusty 1982 Nissan 300SX had died the day after I moved to Colorado, I bought a new car. The expenses kept mounting because, hey, I had money!

Four years later, I left Hughes (then Raytheon) for a consulting job in Boulder. My salary had ballooned in those four years, and after three promotions I was doing pretty well. The funny thing is how no matter how much you make (or don’t make), your expenses tend to fit your income. By then I was married with two kids, and didn’t seem to be putting any more money into savings or whatnot. In fact, it seemed like money was always tight. We had a mortgage, car loans, student loans, credit card bills, baby stuff to buy, and on and on.

Now it’s fourteen years later, and every month we look at our credit card statement and ask ourselves, “We spent how much?” To be clear, we have a good lifestyle and don’t have to worry about whether we’ll be able to afford food next month, but we’re hardly extravagant. We don’t go on international trips, we don’t drive fancy cars, and we live in a nice but modest house. I still find it baffling that our expenses have risen right alongside our income. How does that happen?